Equilibrium Transfer Studio to possess Axis Financial Financial

Axis Bank will bring versatile installment options for home loans. Individuals can decide ranging from possibilities such Equated Monthly premiums (EMIs), Step up EMIs, Tranche Founded EMI, plus. It is strongly recommended to talk about the newest possibilities for the bank to get the one that suits debt needs and requirements.

How do i apply for a mortgage away from Axis Bank?

To apply for a mortgage off Axis Financial, you can travel to the formal webpages otherwise get in touch with the fresh new nearby part. The financial institution provides an on-line app techniques where you are able to fill from the necessary information and you can fill out the mandatory records. As an alternative, you can even look at the nearby department getting a facial-to-face conversation that have financing manager that will assist you as a result of the applying process.

Must i transfer my personal present mortgage to Axis Bank?

Sure, Axis Lender provides the substitute for import current home loan off another type of financial on the very own. This course of action is called a home loan balance import. By move your property mortgage to Axis Bank, you might be able to make the most of lower rates or any other attractive have offered by the financial institution. It is best to contact Axis Bank having more information towards the brand new transfer processes and you may qualifications requirements.

Is also worry about-working anybody get a home loan of Axis Bank?

Sure, self-functioning anyone can use having a home loan out of Axis Lender. The bank also offers financial options for both salaried and you can mind-functioning anyone, considering they meet with the necessary eligibility requirements. Self-employed someone may be needed to submit a lot more data such as income tax output, monetary comments, and you will organization facts. Experts recommend to contact Axis Bank having complete details on the latest qualification standards and you may documentation necessary for mind-operating individuals.

What exactly is Axis Lender Home loan?

Axis Lender Mortgage is a kind of loan business given by Axis Bank to prospects for buying a property or assets. It assists people satisfy the dream about home ownership because of the going for the necessary money.

Exactly what are the interest levels given by Axis Lender having Family Money?

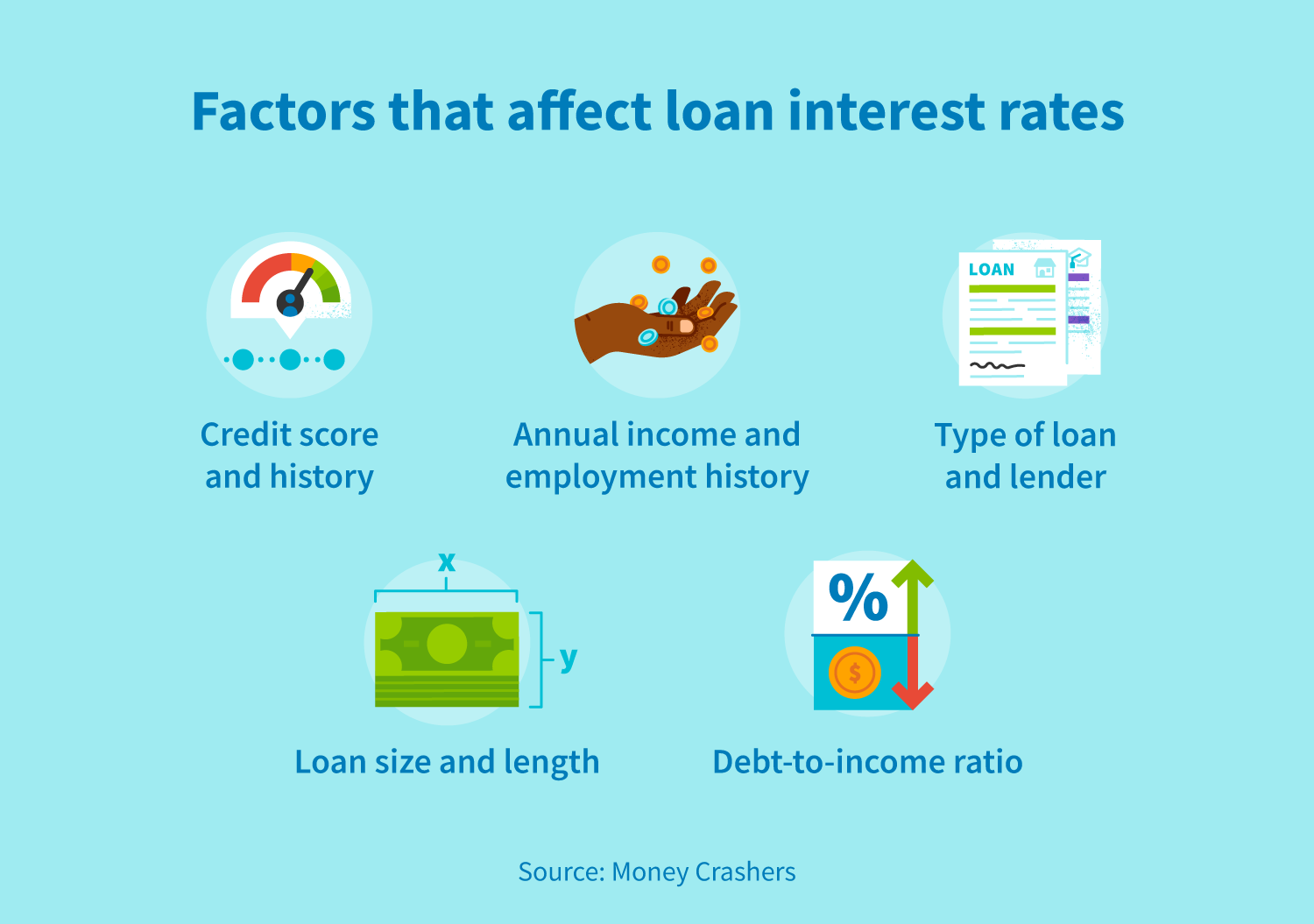

Axis Financial now offers competitive interest rates towards Mortgage brokers. The interest cost ount, tenure, and the borrower’s credit history. It is advisable to check with the lending company or see their website to get the current interest levels offered by Axis Bank.

- Ways to get financing from Axis Lender All you need to Learn

- Axis Bank Has the benefit of Attractive Auto loan Rate of interest for simple Vehicles Resource

- All you have to Realize about Axis Home loan Interest rate

- Get the best Axis Lender Home loan Interest rates for the Fantasy Household!

- Axis Financial The best option to have Loan Finest Upwards

- Select the Current Home loan Interest inside the Axis Financial The Greatest Guide

- Axis Lender Personal loan Interest rates Everything you need to See

- Axis Financial Personal loan Rates of interest Have the best Sales into the Unsecured loans

Axis Lender knows that to acquire a home is a big monetary decision, as loans in Crestone well as try to improve mortgage procedure since the easy and you may smoother that you can. They give glamorous interest levels that are determined based on various things like the loan amount, tenure, and you may borrower’s creditworthiness.

With our house service, you might apply for a home loan from at your house. All of our associate commonly visit you at a time that is smoother for your requirements, whether it is through the day, in the evening, otherwise for the sundays.

Once you prefer a keen Axis Financial mortgage, it is possible to take advantage of aggressive interest levels and easy payment choices. Its flexible cost preparations allow you to pay off the loan convenienty according to the money you owe.

Simple Files Process getting Axis Financial Financial

Not just really does Axis Lender give competitive rates, nonetheless also have small and you can much easier loan operating. With Axis Lender, you can enjoy versatile repayment possibilities that have tenures anywhere between 1 so you can three decades, making it easier on exactly how to pay-off the borrowed funds centered on the money you owe.

There have been two type of home loan insurance rates available options for Axis Bank mortgage brokers. The first is mortgage security insurance coverage, that provides coverage resistant to the borrower’s passing or handicap. If there is such an unfortunate incident, the insurance coverage will make sure that financing try paid off, securing the fresh borrower’s family members in addition to their home.

Which have a great pre-approved home loan give regarding Axis Bank, you might shop with certainty. Knowing how much you are eligible to acquire, you could potentially work on locating the prime home with no monetary suspicion. This will give you a plus whenever settling which have suppliers, as you possibly can make a healthier promote along with your pre-accepted financing in position.

Axis Bank understands that economic items changes through the years. To match these types of change, the bank also offers the possibility to modify your payment plan for the loan period. You might button between more repayment solutions considering the changing monetary requires.

0 comments