Brand new signal may make they more straightforward to key banks and you will transfer debt research, but there is already courtroom pushback

- Texts

A different code from the Consumer Monetary Safeguards Agency seeks to help you allow it to be easier for customers for lots more competitive product sales to own banking, handmade cards, money and other monetary qualities by creating they simpler to transfer the investigation off their newest business.

- Texting

- Print Content blog post hook

That may be because they’re happy with the support it score. However in some instances it can be because it is merely too most of a fuss to maneuver their cash, particularly if they have automated bill money developed.

Constantly, users stick to a bank account that doesn’t complement their requirements since it is as well challenging to improve and you will risk getting recharged an enthusiastic overdraft or later commission when they miss a repeated expenses, said Adam Corrosion, movie director off monetary functions from the User Federation off America.

A special regulating code finalized that it times by Individual Economic Shelter Bureau will eliminate that difficulty and make they smoother, better and always free to have users to switch account otherwise to only import otherwise share their economic data using their banking companies, creditors or other monetary services through to demand.

A lot of Americans is actually stuck within the financial products that have bad pricing and you will solution, told you CFPB manager Rohit Chopra for the an announcement. [The latest rule] offers somebody even more capability to advance cost and solution into bank account, playing cards and much more.

Although code, and that is not arranged to go into impression until 2026 to own high financial institutions and you will 2030 getting less of those, has already been up against a possible roadblock in the way of a beneficial lawsuit registered of the banking contacts.

How signal would work

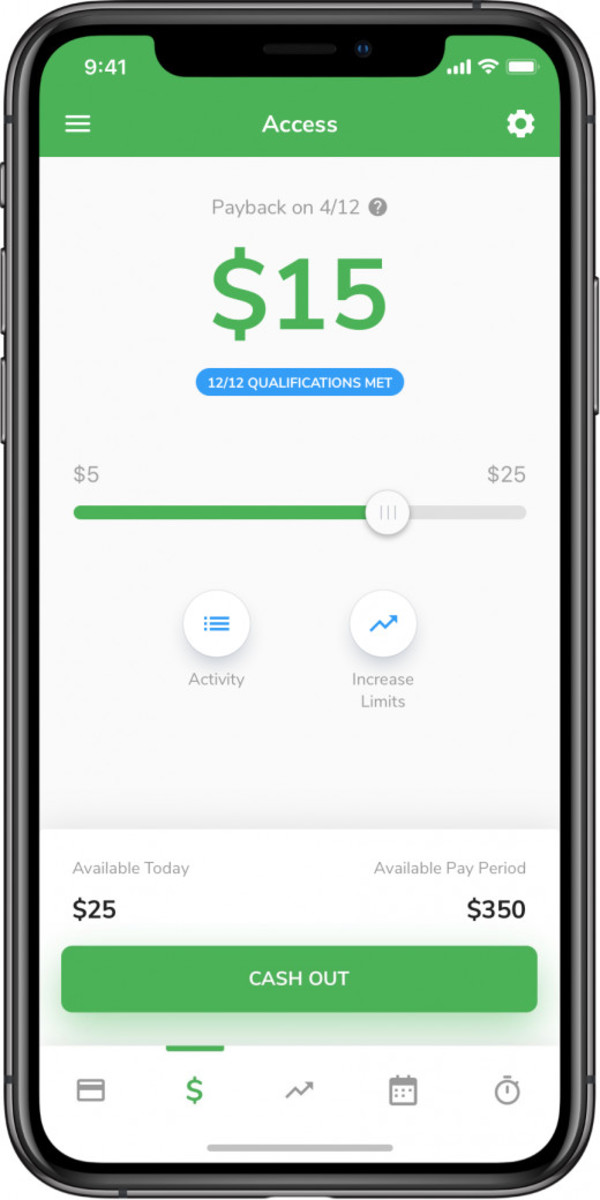

For those who have a checking account, charge card otherwise cellular purse, there can be situations where we wish to import the important computer data – instance purchase records, on line statement purchasing information and other information necessary to facilitate a cost, submit an application for financing otherwise establish a new savings account.

Currently, you probably need to do particular strive to get the analysis transmitted from just one place to some other or even to an individual fund government app or other fintech provider.

The trouble the brand new CFPB (rule) is actually dealing with ‘s the records required out of people to alter account. … (C)onsumers need to vent the bill-shell out index as well as their repeating ACH sales, and for the second, that may only be done yourself, Rust told you. It’s around three days into the a friday.

Specifically, beneath the code according to CFPB, people should payday loan? be able to supply, or authorize an authorized to gain access to, analysis particularly deal pointers, account balance pointers, advice needed to begin costs, then bill pointers, and you can first membership verification pointers. Economic business need get this advice readily available in place of battery charging charge.

This new code might maximum exactly how businesses are able to use and you may take care of the study users consult feel mutual. It will, including, need people getting someone’s studies to act with respect to one to consumer however, just for just what people demands.

Which means companies cannot present an installment product that spends your data, however use your research facing your of the feeding it to help you a personalized models you to looks like charging a lot more getting a keen air travel ticket and other service. That isn’t everything was basically in the industry to acquire, Chopra told you when you look at the a speech in the Government Set-aside Bank off Philadelphia.

And you can, the guy added, it might allow it to be more comfortable for consumers to find the loan facts they require without the need to rely very heavily to the credit rating. If the a customer determines, they may ensure it is mortgage brokers to utilize data using their examining membership to their earnings and you can expenditures regarding the underwriting techniques. These records could help supplement and you can improve precision out of old-fashioned credit histories and help more folks get credit toward top words. Along side long term, this may reduce the human body’s dependence on credit scores, Chopra explained.

Banks break the rules

New banking business wasted no time inside stating the displeasure having new rule – known as the private monetary study rights signal. (I)t is obvious that our longstanding concerns about extent, accountability and cost are nevertheless largely unaddressed. This is certainly disappointing once unnecessary numerous years of an effective-faith work because of the activities into the all of the sides to improve consumer outcomes, Deprive Nichols chairman and Chief executive officer at the American Bankers Relationship, told you inside the a statement.

The new suit – filed by the Financial Coverage Institute, brand new Kentucky Lenders Relationship and you will Kentucky-created Forcht Bank – alleges that CFPB overstepped the legal expert and this the code throws on the line consumer confidentiality, the economic study and you can membership safeguards – effortlessly upending just what financial institutions assert try an already well-working ecosystem which is thriving not as much as private effort.

Jaret Seiberg, economic characteristics rules specialist at the TD Cowen Arizona Search Class, said he thinks the banks get remain a chance of prevailing. Dodd-Honest merely demands financial institutions to add financial analysis to people. It does not mandate you to definitely finance companies offer analysis so you’re able to tens of thousands of industrial agencies that have unfamiliar back ground otherwise shelter standards, Seiberg told you last week in the a regular research note. New CFPB also wants financial institutions to ensure third parties provides robust safeguards techniques, but limitations the art of banking institutions so you can impose criteria.

The brand new CFPB hasn’t approved a formal a reaction to the fresh lawsuit, though Chopra, speaking at the a conference into the Las vegas to the Week-end, said he could be perhaps not amazed you to definitely some of the biggest participants are the ones who would like to slow they and you can prevent it. They actually had such as for example an excellent 50-web page suit ready contained in this circumstances of us being completed. I haven’t read its lawsuit and i don’t think they usually have comprehend this new laws.

0 comments