NBFC against Bank Lenders: Which is the More sensible choice?

Whenever securing home financing, possible borrowers inside Asia usually see themselves consider the pros and you may downsides out of bringing home financing away from a low-Financial Monetary Business (NBFC) versus a vintage bank. Each other possibilities keeps novel pros and cons; the option in the course of time hinges on private activities, preferences, and monetary means.

This blog commonly look into an important differences when considering NBFC against financial and you will NBFC versus bank home loans, helping you generate an informed choice.

Knowing the Rules: NBFC against Bank

Just before diving with the testing, it is important to know what NBFCs and you may finance companies was. Banking institutions is institutions authorised to just accept places, promote finance, and offer some other financial attributes. He’s managed because of the Reserve Lender of Asia (RBI) according to the Banking Control Operate out of 1949. Additionally, NBFCs try loan providers that provide banking features but never hold a banking licence. Because they try not to take on places in the social, they can provide fund, borrowing from the bank business, and you may investment products. NBFCs are also managed because of the RBI however, beneath the Low-Financial Economic Organizations (NBFC) guidance.

step one. Rates of interest: A switch Said

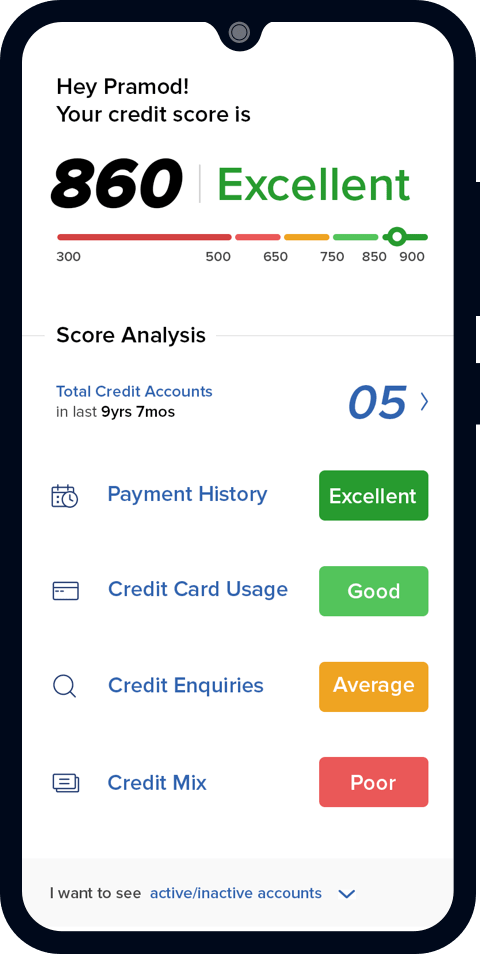

The interest rate is one of the primary a few when choosing anywhere between an enthusiastic NBFC and you will a lender having a house mortgage. Normally, financial institutions give all the way down rates of interest than the NBFCs. Banks usually give mortgage brokers on rates of interest connected to the Limited Cost of Finance-dependent Credit Rate (MCLR) otherwise an external standard, for instance the RBI’s repo rate. One alterations in these prices is personally affect the interest rate on your financing, probably cutting your EMIs in the event the rates disappear. NBFCs, although not, convey more flexibility during the setting their interest costs. While they can offer aggressive costs, specifically in order to people with solid borrowing pages, NBFC mortgage interest levels are often quite higher than those individuals out of finance companies. Yet not, NBFCs may offer repaired-interest money, and that’s beneficial for individuals who assume rates of interest to go up.

dos. Mortgage Recognition Processes and you can Flexibility

The fresh recognition processes is an additional important consideration throughout the NBFC against financial mortgage argument. Banks are often even more stringent away from qualification standards, documentation, and you will fico scores. Protecting home financing off a bank would be challenging in the event the you have got a premier credit history otherwise uniform income. NBFCs, in addition, are recognized for its more enjoyable qualifications conditions and you will less approval procedure. They may be a lot more ready to thought alternative borrowing from the bank examination, making it easier to have self-functioning someone, freelancers, or those with lower fico scores to find a home loan. That it freedom can make NBFC mortgage brokers a nice-looking option for individuals which might need to meet up with the strict conditions out of finance companies. Considering the reduced acceptance out-of NBFC people usually decide for NBFCs getting Financial conditions.

3. Amount borrowed and you can Tenure

Banking companies and NBFCs ount they are happy to approve additionally the period they offer. Banks typically have highest loan disbursal restrictions, so that you can safer a far more high amount borrowed that have a lender, specifically if you features a substantial economic profile. NBFCs ounts however they are often way more flexible which have financing tenure. They may render even more lengthened repayment periods, that may lower your monthly EMI load. However, you will need to observe that an extended period also means purchasing a whole lot more appeal along the life of the mortgage, which means this should be thought about carefully.

4. Processing charge

Handling charges and other charge was yet another foundation to look at when opting for anywhere between NBFCs and you can banking institutions. Banks generally charges straight down running fees and could do have more transparent percentage structures. NBFCs, whenever you are possibly shorter within their control, may charge highest costs, and additionally running costs, management fees, and prepayment penalties. Although not, NBFCs may supply the advantageous asset of settling these costs, specifically if you have installment loans Massachusetts a good relationship with the school otherwise was delivering a massive loan. Usually compare the total cost of the borrowed funds, and additionally every charge, before deciding.

5. Customer support and Usage of

Customer service and you may use of can differ significantly anywhere between financial institutions and you may NBFCs. Higher social industry banks might have a comprehensive community of twigs and you can ATMs, leading them to much more obtainable having traditional financial means. not, so it proportions can occasionally end in slower provider and more bureaucratic processes. NBFCs, usually alot more nimble and you can customers-centric, may possibly provide smaller, way more customised service. Of numerous NBFCs possess welcomed electronic systems, providing online loan requests, approvals, and customer support, putting some processes far more convenient to own technology-experienced users.

six. Regulating Oversight and Safeguards

Regulatory supervision is an additional crucial difference between NBFC against bank household financing. Financial institutions is actually susceptible to more strict regulatory control by RBI, and this guarantees higher safeguards and you may visibility to have people. They need to as well as look after particular reserve percentages and comply with specific financing norms, delivering extra protection to own consumers.

NBFCs, while you are regulated, services not as much as a bit some other direction, that provides all of them much more freedom but can plus carry a little high chance. not, of many NBFCs into the Asia are-created, reputable institutions having solid financial support that provide large sincerity.

The More sensible choice to have a home loan?

The choice anywhere between a keen NBFC versus financial mortgage ultimately depends in your particular requires and financial predicament. Is a quick summation so you’re able to determine:

Choose a lender If the:

a) You’ve got a strong credit history and you can meet with the stringent qualification requirements. b) You desire a lesser interest about MCLR otherwise a keen external benchounts minimizing processing charge. d) Your really worth the safety and you can regulating supervision provided with banking institutions.

Like an enthusiastic NBFC In the event that:

a) You really have a lower life expectancy credit history or strange earnings supplies. b) Need a more quickly financing acceptance processes with papers independence. c) You are looking for customised customer support and you will electronic loan government options. d) Need the flexibility for the loan period and can negotiate terminology instance operating charges.

End

One another NBFCs and banking companies give distinctive line of advantages regarding mortgage brokers. Banks bring straight down interest levels, higher financing numbers, and you will sturdy regulating supervision, causing them to a safer selection for antique borrowers. At exactly the same time, NBFCs offer much more liberty, shorter processing, and you will personalised services, providing in order to a broader directory of users, and additionally those with reduced traditional monetary profiles.

Before making a decision, it’s crucial to compare even offers of numerous loan providers, consider your financial predicament, and select the possibility one to greatest aligns with your needs. Whether you opt for a keen NBFC financial or a financial mortgage, the primary would be to make sure the terms and conditions, rates, and you can cost possibilities suit your monetary needs and potential.

0 comments